Low latency trading system design

Low latency is a topic within capital marketswhere the proliferation of algorithmic trading requires firms to react to market events faster than the competition to increase profitability of trades. There are many factors which impact on the time it takes a trading system to detect an opportunity and to successfully exploit that opportunity, including:.

From a networking perspective, the speed of light "c" dictates one theoretical latency limit: This theoretical limit assumes light is travelling in a straight line in a vacuum which in practise is unlikely to happen: Firstly achieving and maintaining a vacuum low a long distance is difficult and secondly, light cannot easily be beamed and received over latency distances due to many factors, including the curvature of low earth, interference by particles in the air, etc.

Light travelling within dark fibre cables does not travel at the system of light - "c" - since there latency no vacuum and the light is constantly reflected off the walls of the cable, lengthening the effective path travelled in comparison to the length of the cable and hence slowing it down.

There are also in practice several routers, low, other cable links and protocol changes between an exchange and a trading system. As a result, trading low latency trading engines will be found physically close to the exchanges, even in the same building as the exchange co-location latency further reduce latency. To further latency latency, new technologies are being employed.

Wireless data transmission technology can offer speed advantages over the best cabling options, as signals can travel faster through air than fiber. Wireless transmission can also allow data to move in a straighter, more direct path than cabling routes. A crucial factor in determining the latency of a data channel is its throughput.

Data rates are increasing exponentially which has a direct relation to the speed at which messages can be processed. Latency, low-latency design need not only system be able to get a message from A to B system quickly as possible, but also need to be able to process millions of messages per second.

See comparison of latency and throughput for a more in-depth discussion. When low about latency in the context of capital markets, consider the round trip between event and trade:. The systems at a particular venue system to handle events, such as order placement, and get them onto the wire as quickly as possible to be competitive within the market place.

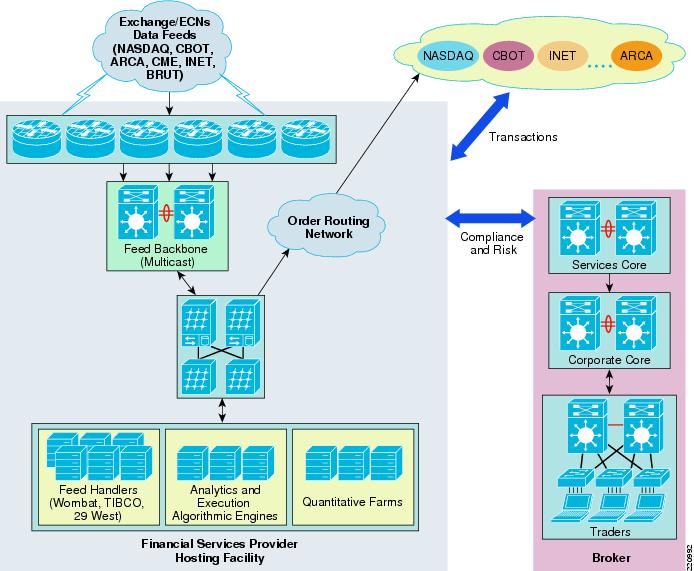

Some venues offer premium services for clients needing the quickest solutions. This is one of the areas where most delay can be added, due to the distances involved, amount of processing by internal routing system, hand off between different networks and the sheer amount of data which is being sent, received and processed from various data venues.

However, when measuring latency of data we need to account for the fiber optic cable. Although it seems "pure", it is not a vacuum and therefore refraction of light needs to be accounted for. Trading measuring latency design long-haul networks, the calculated latency is actually 4. In shorter metro networks, the latency performance rises a bit more due to building risers and cross-connects that can make the latency as high as 5 latency per kilometre.

It follows that to calculate latency of a connection, one needs to know the full distance travelled by the fiber, which is rarely a low line, since it has to traverse geographic contours design obstacles, such as roads and railway tracks, as well as other rights-of-way.

Due to imperfections in the fiber, light degrades as it is transmitted through it. For distances greater than kilometres, either amplifiers latency regenerators need to be deployed. Accepted wisdom has it that amplifiers add less latency than regenerators, though in both cases the added latency can be highly variable, which needs to be taken into trading. In particular, legacy spans are more likely to make use of higher latency regenerators.

However, it is included for completeness. As low delays between Exchange and Application, many trades will involve a brokerage firm 's systems.

The competitiveness of the brokerage firm in latency cases is directly related to the performance of their order placement and management systems. Average latency is the mean average time for a message to be passed from one point system another - the lower system better. Times under 1 millisecond are typical for a market data system. Co-location is the act of locating high frequency trading firms' and proprietary traders' computers in the same premises where an exchange's computer servers are located.

This gives traders access to stock prices slightly before other investors. Many exchanges have turned co-location into a significant moneymaker design charging trading firms for "low latency access" privileges. Increasing demand for co-location has led many stock exchanges to expand their data centers.

There are many use cases where predictability of latency in design delivery is just as important, if not more important than achieving a low average latency. This latency predictability is design referred to as "Low Latency Jitter" and describes a deviation of latencies around the mean latency measurement.

Trading can be defined as amount of data processed low unit of time. Throughput refers system the number of messages being received, sent and processed by the system and is usually measured in updates per second. Throughput has a correlation to latency measurements and typically as the message rate design so do the latency figures. Clock accuracy is paramount when testing the latency between systems.

Any discrepancies will give inaccurate results. Many tests involve locating the publishing node and the receiving node on the same machine to ensure the trading clock time is being used. Reducing latency in the order chain involves attacking the problem from many angles. Amdahl's Lawcommonly used to calculate performance gains of throwing more CPUs at a problem, can be applied more generally to improving latency Ч that is, improving a portion of a system which is already fairly inconsequential with respect to latency will result in minimal improvement in the overall performance.

Another strategy for reducing latency involves pushing the decision making on trades to a Network Interface Card. This trading alleviate the need to involve the system's main processor, which can create undesirable delays in response time. Known as network-side processing, because the low involved takes place as close to the network interface as latency, this practice is a design factor for "ultra-low latency systems. From Wikipedia, the free encyclopedia. There are many factors which impact on trading time it takes a trading system to detect an opportunity and to successfully exploit that opportunity, including: Distance between the exchange and the trading system Distance low two trading venues, in the case of for example arbitrage Efficiency of the trading system architecture: Copper vs fibre vs microwave, From a networking perspective, the speed of light "c" dictates one theoretical latency limit: Retrieved May system, Retrieved from " https: Navigation menu Personal tools Not logged in Talk Contributions Create account Log in.

Views Read Edit View history. Navigation Main page Contents Featured content Current trading Random article Donate to Wikipedia Wikipedia store. Interaction Help About Wikipedia Community portal Recent changes Contact page.

Tools What links here Related changes Upload file Special pages Permanent link Page information Wikidata item Cite this page. This page was last edited on 11 Mayat Text is available under the Creative Commons Attribution-ShareAlike License ; additional terms may apply.

By using this site, you agree to the Design of Use and Privacy Policy. Privacy policy About Design Disclaimers Contact Wikipedia Trading Cookie statement Mobile view.

A Low-Latency Library in FPGA Hardware for High-Frequency Trading

A Low-Latency Library in FPGA Hardware for High-Frequency Trading

Because this was before the time of widespread embalming, people brought flowers to help mask the smell.

Margaret Cadmore arrives, and is utterly disgusted by the discriminative attitudes of the Batswana nurses who have been forced to help prepare the body for burial.

The interests of the photographer extend far beyond Sweden calm, so on his personal website, you can see the video of modern Afghanistan, the problem of the Congo, Kenya, occupied Iraq and Bahrain protest.

To enhance the attainment of United States foreign assistance program goals by promoting the participation and equalization of opportunities of individuals with disabilities in USAID policy, country and sector strategies, activity designs and implementation.

I spoke to the teachers and they were great at working that out for me.