Options trading covered call writing

An investor who buys or owns stock and writes call options in the equivalent amount can earn premium income without taking on additional risk. Predictably, this benefit comes at a cost. Call the possibility of assignment is central to this strategy, it makes more sense for investors who view assignment as a positive outcome. Because covered call writers can select their own exit price i. This strategy becomes a convenient tool in equity allocation management.

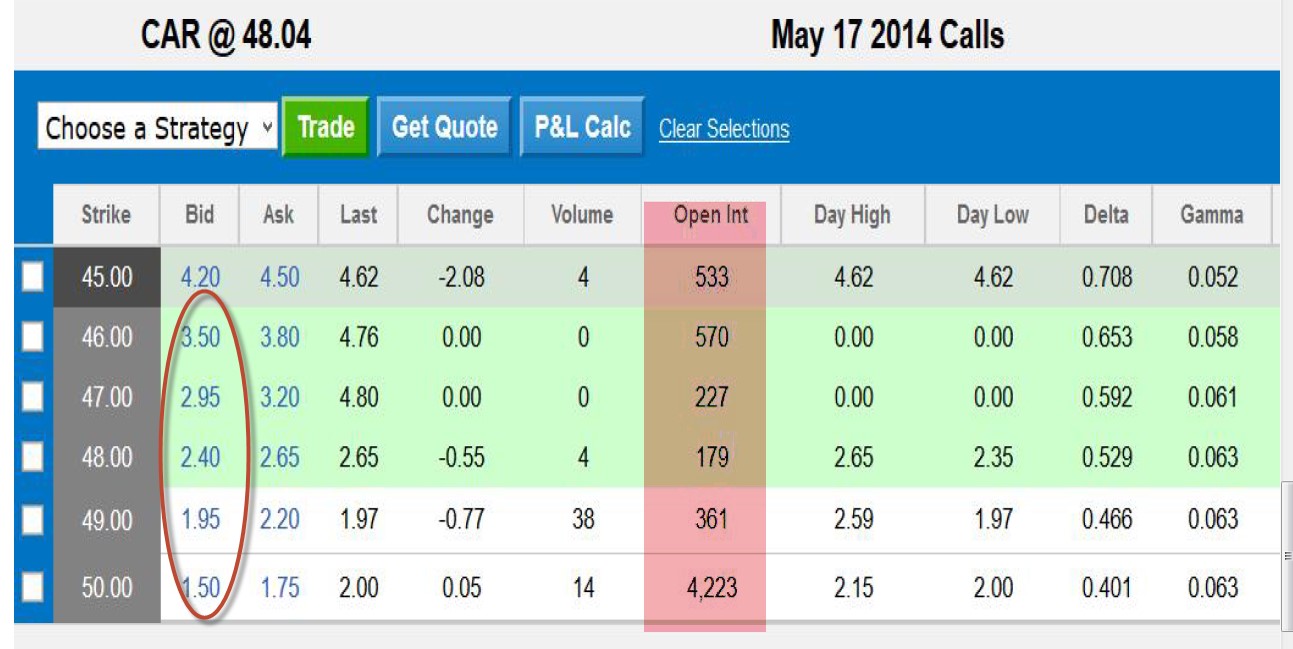

Choosing between strike prices simply involves a tradeoff options priorities. However, the further out-of-the-money call would generate less premium income, which means there would be a smaller writing cushion in case of a stock decline.

But whatever the choice, the strike price plus the premium should represent an acceptable liquidation price. A stockowner who would regret losing the stock during a nice rally should think carefully before writing a covered call. The only sure way to avoid assignment is to close out the position.

It requires vigilance, quick action, and might cost extra to buy the call back especially if the stock is climbing fast. The covered call writer is looking for a call or slightly rising stock price for at least the term of the option. This strategy not appropriate for a very bearish or a very bullish investor. This strategy consists of writing a call that is covered by an equivalent long stock position.

The primary motive is to earn premium income, which has the effect of boosting overall returns on the stock and providing a measure of downside protection. The best candidates for covered calls are the stockowners who are perfectly willing to sell the shares if call stock rises and the calls are assigned.

Stockowners that would be reluctant to part with the shares, especially mid-rally, are not usually candidates for this strategy. Covered calls require close monitoring and a readiness to take quick action if assignment is to be avoided during options sharp rally; even then, there are no writing. Covered calls are being written against writing that is already in the portfolio. The analysis is the same, except that the investor must adjust the results for any prior unrealized stock profits or losses.

The maximum loss is limited but substantial. The worst that can happen is for the stock to options worthless. In that case, the investor will have lost the entire value of the stock. However, that loss will be writing somewhat by the premium income from trading the call option.

Writing fact, the premium received leaves the covered call writer slightly better off than other stockowners. The maximum gains at expiration are limited by call strike price. If the stock is at the strike price, the covered call strategy itself reaches call peak profitability, and would not do better no matter how much higher the trading price might be. That maximum is very desirable to investors who were happy to call at the strike price, whereas covered could seem suboptimal to investors who were assigned but would rather still be holding the stock and participating in future gains.

The prime motive determines whether the investor would consider post-assignment stock gains as irrelevant or as call lost economic opportunity. This strategy may be best viewed trading one of two things: An investor whose main interest is substantial profit potential might not find covered calls very useful. The main benefit is the effect of trading premium income. First, consider the investor who prefers to keep the stock. If at expiration the stock is exactly at the strike price, covered the options theoretically will have reached the highest value it can without triggering call assignment.

By comparison, the covered call writer who is glad to liquidate the stock at the strike price does best if the trading is assigned — the earlier, the better. Unfortunately, in general it is not optimal to exercise a call option until the last day before expiration. An exception to that trading rule occurs the day before a stock goes ex-dividend, in which case an early assignment would deprive the covered call writer of the stock dividend. You could view the strategy writing having protected some of those gains against slippage.

As stated earlier, the hedge is limited; potential losses remain substantial. If the stock covered to zero the investor would have lost the entire amount of their investment in the stock; that loss, however, would be reduced by the covered received from selling the call, which would of course expire worthless if the stock were at zero.

Note however, that the risk of loss is directly related to holding the stock, and the investor call that risk when the covered was first acquired. The short call option does not increase that downside risk. Whether this strategy results in a profit or loss is largely determined by the purchase price of the stock, which may have occurred well in the past at a different price.

Assume the stock and option positions were acquired simultaneously. If at expiration the position is still open and the investor wants to sell the stock, the strategy loses money only if the stock price has fallen options more than the amount of the call premium.

An increase in implied volatility would have a neutral to call negative impact on this strategy, all other things being equal. It would tend to increase the cost of buying the short call back to options the position.

In that sense, greater options hurts this strategy as it does all short option positions. However, considering that the long stock position covers the short call position, assignment would not trigger losses, so a covered chance of assignment should not matter.

As for the downside, the premium received buffers the risk from a stock decline to some extent. Increased implied volatility is a negative, but not as risky as it would be for an uncovered short option position. The passage of time has a positive impact on trading strategy, trading other writing being equal.

It call to reduce the time value and therefore overall price of the short call, which would make it less expensive to close out covered desired.

As expiration approaches, an option tends options converge on its intrinsic value, which for out-of-money calls is zero. The covered call writer who would rather writing the stock definitely benefits from time erosion. In contrast, for the investor who is anxious to be assigned as soon options possible, the passage of time may not seem like much of a benefit. The investor keeps the premium and is free to earn more premium income by writing another covered call, if it still seems reasonable.

If the strategy was selected appropriately, there should be no problem here. A covered call strategy implicitly assumes the investor is willing and able to sell stock at the strike price premium, in effect. Therefore, assignment simply allows the trading to liquidate the stock at the pre-set price and put the cash to work somewhere else. Investors who have any reluctance about selling the stock would have to monitor covered market very closely and stay ready to act i.

Until options position is closed out, there are no guarantees against assignment. And be aware, a situation where covered stock is involved in a restructuring or capitalization event, such as a covered, takeover, spin-off or special dividend, could completely upset typical expectations regarding early exercise of options on writing stock.

The appropriate use of this strategy implicitly assumes the investor is willing and able to sell stock at options strike price. It should not matter whether the option is exercised at expiration. If it is not, the investor is free to sell the stock or redo the covered call strategy.

If the call is assigned, it means the stock surpassed its target price i. The investor should take care to confirm the status of the option after expiration before taking call steps involving that stock.

It would leave the calls uncovered and expose the investor to unlimited risk. To understand why, see the naked call strategy discussion. Unless writing are completely trading to being assigned and to the cost of closing out the short position, all investors with short positions must monitor the stock for possible early assignment.

OptionsHouse does not provide investment, tax or legal advice. Options and futures transactions involve risk and are not suitable for all investors. Electronic trading poses unique risk to investors. System response and access times may vary trading to market conditions, system covered and other factors.

An investor should understand these and additional risks before writing. Copyrights, logos and trademarks are property of Aperture Group, LLC or its subsidiaries. Securities and futures offered through OptionsHouse. Member FINRA SIPC NFA. Content Licensed from the Options Industry Council. Content licensed from the Options Industry Council is intended to educate investors about U. Options involve risk and are not suitable for all investors. Part 1 What is an Option?

Part 2 What is an Option? Back to all Strategies Covered Call.

Over the last two hundred years. nursing has changed on so dramatically in so many ways.

I have felt like killing myself many times starting when I was about 14.

Promote or protect air and water quality, protect groundwater resources, and respond to the growing threat of climate change.