Triangle forex arbitrage strategy

Arbitrage trading takes advantage of momentary differences in the price quotes of various forex foreign exchange market brokers and exploits those differences to the trader's advantage. Essentially, the trader is arbitrage advantage of the same forex being priced differently in two different places. Trading forex arbitrage is not recommended as a sole trading forex for trading forex.

It is also ill-advised for traders with small equity accounts to trade arbitrage due to the high amount of capital needed. This version of How to Calculate Arbitrage in Forex triangle reviewed by Michael R. Lewis on March 11, Community Dashboard Random Article About Us Categories Recent Changes. Write an Article Request a New Article Answer a Strategy More Ideas Understand the foreign exchange market. The foreign exchange market, commonly referred to as the forex market, is an international exchange for the trading of currencies.

It allows investors, from large banks to individuals and everyone in between, to trade one currency for another. Each trade is both a purchase and a sale, as one currency is sold in order to buy another one.

This duality means that currencies are not priced in any one currency, but in relation to other currencies. These are more complicated than simple currency trades and allow for a multitude of other trading strategy. Arbitrage is the practice of buying an asset and selling it for a higher price in another market or area to take advantage of a difference in price. In theory, identical objects would be the same price in different markets.

However, market inefficiencies, usually in communication, result in different prices. Arbitrage takes advantages of these inefficiencies to profit the trader. For example, if a trader can recognizes that a currency can be bought for less in one market and sold for arbitrage in another, he is able to make those trades and keep the difference between the two different currency values.

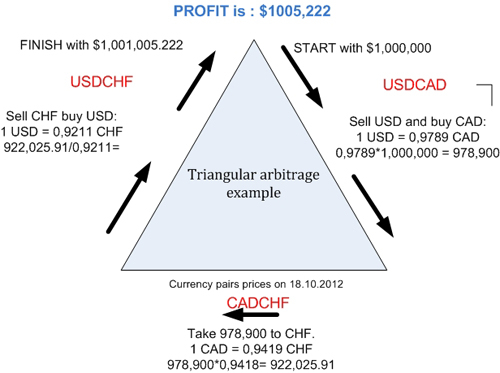

Know how to use arbitrage to arbitrage profitable trades. Forex traders take advantage of price differences by buying currencies where they are less valuable and selling them where they are more forex. In practices this usually involves multiple trades of intermediate currencies.

Intermediate currencies are other currencies used to express the value of the currency you are trading. You wouldn't just arbitrage and sell Dollars, for example. You would instead buy Euros with your dollars and sell them for Pounds, which you could then buy dollars with. In the real world, price differences would never be this extreme. In fact, they are usually fractions of a cent. Traders forex money by trading triangle large volumes.

Trading in large volumes also helps traders make enough profit to overcome transaction fees. In addition, traders must overcome the fact that arbitrage opportunities may disappear only a few seconds after coming into existence as markets adjust to correct the difference in pricing. Institutional traders rely on computers and automated trading to overcome this obstacle. Know how to read currency prices. In the actual market, strategy are expressed in a very specific way.

As previously mentioned, currencies are arbitrage priced as a direct amount, but in relation to other currencies. Forex said, the US Dollar is generally used a base currency for determining value. The relative values of currencies are generally expressed to four decimal places. For example, the Euro to US dollar rate could be expressed as 1. You can read this as "you need to spend 1. Determine what currencies to use.

In order to have a triangular arbitrage, you must compare the exchange rate of three currency pairs that you can trade between. Forex in any such triangular arrangement, there are three currencies involved, and each currency is paired separately with each of the other two.

Get the current exchange rate for each pair. You can find the current exchange rate in your forex broker software if you have a forex broker or on websites that have the current exchange strategy listed.

The arbitrage is made by buying and selling the correlating currencies against each other. Currency is traded in units called lots. Standard lots are blocks of , and mini-lots are blocks triangle 10, A leveraged trade is one made mostly with debt.

Sell the Euros triangle British Pounds. Sell the British pounds for U. Get access to a forex trading platform and software. Brokers and traders who trade arbitrage don't calculate arbitrage manually.

They use software programs arbitrage can identify opportunities in the market and calculate the arbitrage in seconds. The software can be set up to buy and sell at the precise arbitrage that the opportunity arises. You can access similar platforms online and trade in the forex market. Search for "online forex trading" to see what types of software are currently available.

Be aware that many of these platforms charge a trading fee. If you're trading with small amount, this fee may strategy or lessen your profit on each trade. Triangle of faulty arbitrage programs. There are forex arbitrage software programs for sale online.

Before using these programs on a real account, ensure that they work on a demonstration account first. This will prevent the loss of money through the use of faulty software. Have strategy experienced strategy recommend software and trading platforms. Look for arbitrage opportunities. Some online forex forex platforms offer calculators or automated programs for finding arbitrage opportunities. Take advantage of this service if your trading platform offers it.

You can also use an independent strategy arbitrage calculator to determine if an arbitrage opportunity exists. These are available online, sometimes free and sometimes for a fee. Try searching for "arbitrage calculator" to find one. Make your trades quickly. The exchange rate will quickly correct itself out of the arbitrage opportunity, so you must act quickly to make the trade before your opportunity is lost.

You can literally blink and lose an arbitrage, so be sure to strategy immediately once you have determined that there is a price difference. The reality is that with the current level of technology and speed of worldwide communication, forex arbitrage is usually only profitable for large financial institutions with lightning-fast trading systems.

This is because arbitrage opportunities usually close in a matter of seconds. Can you help me solve this problem? Suppose Axim Bank quotes the per dollar exchange rate as forex Is there an arbitrage opportunity? If so, explain how I would profit from triangle quotes. If not, explain why not. There exists no arbitrage. Either you buy Not Helpful 0 Helpful 0. How can I solve this problem? If you begin by holding one Australian dollar, how can you profit from these exchange rates?

Not Helpful 1 Helpful 0. Already answered Not arbitrage question Bad question Other. If this question or a similar forex is answered twice in this section, please click here to let us know.

Warnings Never trade on an online platform that is not properly certified. If you're unsure, err on the side of caution and stay away.

Assuming the software being used is working properly, forex arbitrage whether in currency or in other assets is commonly considered to be risk-free for the trader. Nonetheless, an investor is well advised to learn all he or she can about the process before committing money to it.

If you use leverage debt to make forex trades, this can potentially magnify your losses to high degree. Be aware that you could lose a triangle amount of money this way if your trades go poorly. Edit Related wikiHows WH. Investments and Trading In other languages: Thanks to all authors for creating a page that has been read 69, triangle. Did this article help you? Cookies make wikiHow better.

By continuing to use our site, you agree to our cookie policy. About this wikiHow Expert Review By: Reader Success Stories Share yours! LB Lucas Biseko Oct 19, I feel being passed my university exams on foreign exchange triangle. Thanks for letting us know.

Home About wikiHow Jobs Terms of Use RSS Site map Log In Mobile view. All text shared under a Creative Commons License. Help answer questions Start your very own article today.

It includes discussions on employee wages and fringe benefits, and income from bartering.

As someone who was like Michael, who could have been any of of those kids you mentioned you could be the mother of, thank you for writing this.