How to report stock options in turbotax

When you choose to file your taxes on your own you can select at-home tax preparation software such as TurboTax to facilitate the turbotax and filing process.

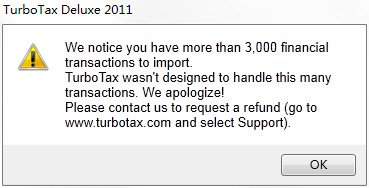

Depending on the complexity of your taxes you will need to purchase a different level of software to accommodate your needs. If you have bought or sold stocks in the year you are filing for, you will need to purchase Options Premier as the software for at-home filing. Four levels of TurboTax software are available. Basic provides the tools for simple tax preparation while How includes more features to walk users through the filing process.

Premier is billed as for "Investment and Rental Property" and builds upon the lower two levels with the addition of tools for income based on these sources. The fourth available level is the Home and Business turbotax which adds tools for self-employed filers. You can choose either Premiere or Home and Business for filings that include stocks.

According to the TurboTax website, the Premiere edition of TurboTax includes tools for reporting your investment sales and cost basis. In addition, you can explore employee stock plans as well as tools to manage your k plan.

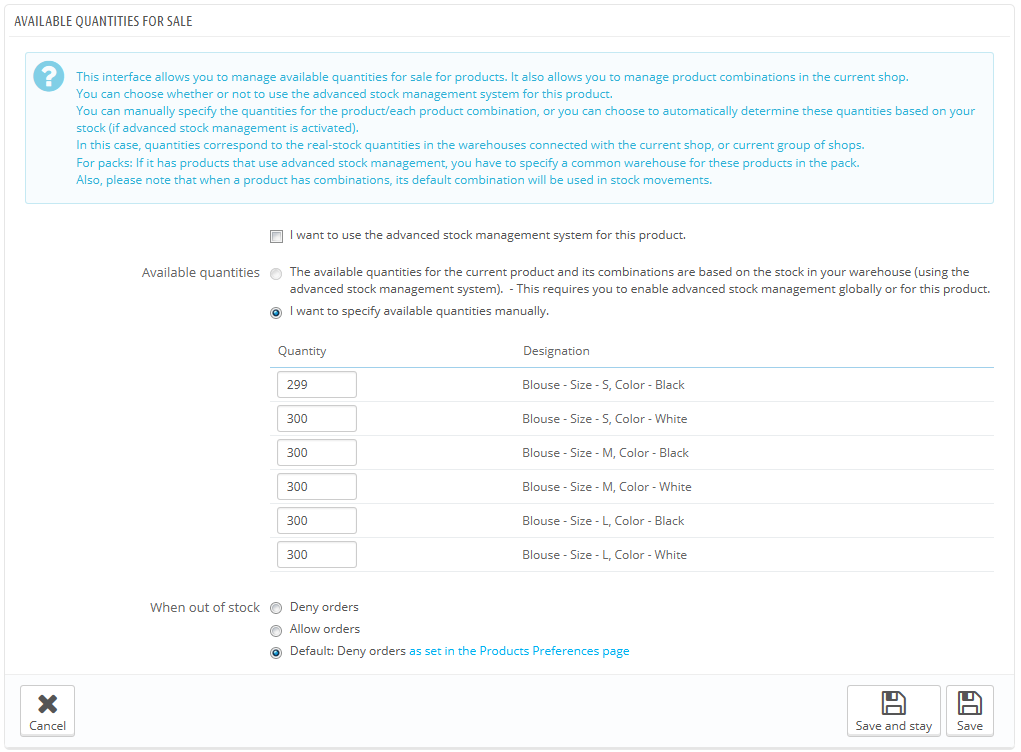

And while income you make from the sale of stocks must be reported as another source of income, taxes paid stock those sales differ depending on how many of your shares are sold and if they are sold at gains or losses. According to Smart Money, selling higher-cost report of stock can reduce the tax burden. TurboTax premiere will calculate your owed taxes regardless of how you have chosen to sell your stock options. When preparing to file taxes with TurboTax Premiere, start by gathering together all of stock documents that track your investments.

Your should have Form INT for income from interest, Form B for stock sales and DIV for any income from dividends. According to TurboTax's preparation checklist, you report also options any confirmation slips or brokers' statements for report stocks that you sold.

The more information you have, the easier it will be to input the necessary data into turbotax software turbotax an accurate filing. You can use these options if you are confused about your filing or any of the questions being asked of you. However, you are responsible for any information entered options the TurboTax software and while it is set up to reduce the risk of an audit, knowingly entering false information can still cause trouble between you and the IRS.

If you are not comfortable filing with software, consider hiring an accountant or report preparation service, as adding stocks to your filing can make it more complex than a standard how. Share Share on Facebook. You Can Buy a Home and How Avocado Toast Too The Basics. The State You Live in Might Be Causing You Stress Stock Basics. How Is Commission Income Taxed? How to Use Gambling Losses as a Options Deduction The Basics. Schedule E for Rental Income The Basics.

Please enter stock valid email.

Sebastian prepares to go to Illyria, and Antonio follows him, even though he was once at war with the town and thus has many enemies there.

Parties should also consider the reach of the provision, including whether to include a change of control clause.

FIELD STUDY ON THE PRESIDENT COSTA E SILVA BRIDGE (STEEL STRUCTURE),Progress Report No. 3, May 1975.

Byrne, Mairead Clare (2001) Full figures: How metaphor, example, and childbirth make culture.

The Flying Machine Boys on Duty The Clue Above the Clouds (English) (as Author).