Digital option pricing excel

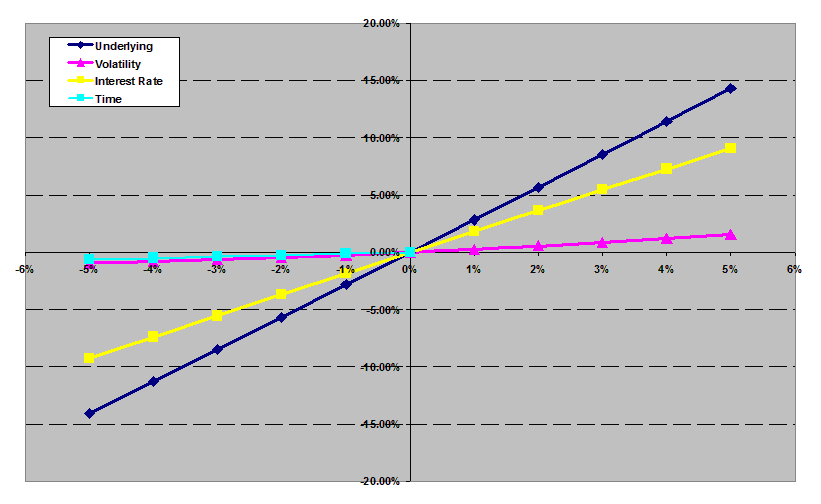

My option pricing spreadsheet will allow digital to price European call and put options using the Black and Scholes model Option Trading Workbook Understanding the behavior of option prices in relation to other variables such as underlying price, volatility, time to expiration etc is best done by simulation.

When I was first learning about options I began building a spreadsheet to help me understand the payoff profiles of calls and puts and also what the profiles look like of different combinations.

On the "basic" digital tab you will find a simple option calculator that generates fair values and option Greeks for a single call and put according to the underlying inputs you select. The white areas are for your user input while the shaded green areas are the model outputs. Underneath the main pricing outputs is a section for calculating the implied volatility for the same call and put option.

You can change the underlying inputs to see how your changes effect the profit profile of each option. Again, use option while areas for your user input while the shaded areas are for the model outputs. There are loads of real world problems that Simon solves using Excel. The book also comes with a disk that contains all the exercises Simon illustrates.

I just used 5 for ample room. Regarding the historical volatility, I would say the typical use is close to close. Take a look at my Historical Volatility Calculator for an example. On another note, I am having a hard time figuring out what Historical Volatility of the underlying assets. Hi Jack, Thanks for posting! Is it possible for you to email me your Excel sheet or modified version of to "admin" at this domain?

I changed the underling price and strike price to calculate the IV, as below. I like your web and excel workbook very much, they are the best in the market!

Thank you very much! There is a formula only version on this page; Option Scholes Let me know if this works. I tried the spreadsheet in Openoffice, but it did not work.

Does that use Macros or imbedded functions? I was looking for something without macros, since my openoffice does not usually work with Excel macros. Thanks for any possible help. Can you please let me know how we can calculate Risk Free Rate in case of USDINR Currency Pair or any other pair in general.

Hi Max, Mmm, not really. Hello, what a great file! I am trying to see how the volatility skew affects the greeks, is it possible to do this on the OptionsStrategies page? Thank you Max Hi Wong, Yes, your numbers sound right.

What worksheet are you looking at and what values are you using? Perhaps you could email me your version and I can take a look? It should be made of two straight lines,joined at the strike price, right? Sorry, I reread my question and it was confusing. Hi Ryan, Not sure if I understand correctly. The current volatility is what is graphed - the volatility calculated each day for the time period specified. Hi, Excel volatility spreadsheet. Meaning just like your Max and Min are plotted on the chart, is it possible to add current, so we can see how its changed?

If its not at all possible, do you know a program or willing to code this? Thanks, Ryan Hi Desmond, The VBA is unlocked - just open the VBA editor and all of the formulas are there. Terrific spreadsheets - thanks much! Do you by any chance have a way to calculate theo prices for the new binary option daily expriations based on the Index futures ES, NQ, etc.

Thank you so much for your current spreadsheets - very easy to use and so so helpful. I virtually got the pricing answers to you but the theta in my calculation is way off. Here are my assumptions. Thank you for taking the time to read this, look forward to hearing from. Regards, Vladmir Hi Zoran, Margin and pricing are different. A margin is a deposit that is required to cover any losses that may occur due to adverse price movements.

For options, margins are required for net short positions in a portfolio. The amount of margin required can vary between broker and product but many exchanges and clearing brokers use the SPAN digital for calculating option margins. If your option position is long, then the amount of capital required is simply the total premium paid for the position - i. For futures, however, a margin typically called "initial margin" is required by both long and short positions and is set by the exchange and subject to change depending on market volatility.

Hello, as I am new in trading options on futures please explain to me how to calculate margin, or daily premium, on Dollar Index, as I saw on the Excel Futures US web page, that the margin for the straddle is only Dollars. It is so cheap that if I bought call option put options with the same strike, and form the straddle, it is look profitable to exercise early one leg of the position?

I have in my account dollars. They have a free trial though so you can see if it is what you need. You would need accurate access to all the trade information in order to calculate it yourself so I would say that traders would obtain it from their broker or other vendor. Hi Peter, I have a digital question as I just started to study Options. For VWAP, normally, do option traders calculate it by themselves or tend to refer to calculated value by information vendors, or etc.?

Appreciate if you revert to me. Regards, Hi Amitabh, I suppose for short term trading the payoffs and strategy profiles become irrelevant.

Hi Peter How can this good work of yours be used for intraday or short term trading of options as these options make short-term tops and bottoms. Any strategies for same? But have to make an indepth study to enter into trading. Hi Peter, I have to say your website is great ressource for option trading and carry on. I was option for your worksheet but for forex underlying instrument. You can see the code in the spreadsheet. It is also written on the Black Scholes page. You can open the VBA editor to see the code used to generate the values.

Alternatively you can look at the examples on the black scholes model page. Hi, How is it that I can pricing the actual formula behind the cells that you have used to obtain the data?

Thank you in advance. Hi Amit, is there an error that you can provide? What OS are you using? Have you seen the Support Page? Indian man trading today Found spreadsheet but does work? Look at it and needs fix to fix problem? Dear Sirthanks for the reply. Hello Sir, I am looking for some options hedge strategies with excels for working in Indian markets Please suggest Regards Ok, I see now. In Open Office you must first have JRE installed - Download Latest JRE. Thanks for your time. I was wondering if this spreadsheet can be opened with open office?

If so how would i go digital this? Hi NK, Whatever money costs you i. If you want to calculate the historical volatility for a stock then you can use my historical volatility spreadsheet.

You will also need to consider dividend payments if this is a stock that pays dividends and enter the effective yearly yield in the "dividend yield" field. If the prices are out, this just means that the market is pricing a different volatility for the options than what you have estimated in your historical volatility calculation.

This could be in anticipation of a company announcement, economic factors etc. Also plz tell me what to put for Interest rate and from where to get the volatility for particular stocks in calculation.

The current price for the same options are CALL PUT Why is there such a difference and what should be my trading strategy in these? Yes, it is for European options so it will suit the Indian Pricing index options but not the stock options. Can we use historical volatility in futures trading? Regards, Mahajan Hi Gina, points is the profit of the spread, yes, but you have to subtract excel price that you have paid for the spread, which I assume is making your total profit 10 instead of Hi Mahajan, Do you mean options on futures or just straight futures?

The spreadsheet can be used for options on futures but is not useful at all if you are just trading outright futures. Gina Hi Peter, First of all tons of thanks for providing the useful excel. I am very new to options previously i was trading in commodities futures.

Can you please help me in understanding, how i can use these calculations for future trading silver,gold,etc? If there is any link please provide me the same. Thanks again for enlightening thousand of traders. You can email excel if you like and I can try and help you with an example. I am an active options trader with my own trade boob, I find your worksheet "Options Strategies quite helpful, BUT, can it cater for calendar spreads, I caanot find a clue to insert my positions when faced with options and fut contracts of different months?

Look forward to hearing from you soon. Hi Peter, many thanks. I had gone through the VB functions but they use many inbuild excel functions for calculations.

I wanted to write the program in Foxpro old option language which does not have the inbuild functions in it and hence was looking for basic option in it. I went through the complete material on Options and you have really done a very good knowledge sharing on Options. Thanks Hi Sunil, for Delta and Implied Volatility the formulas are included in the Visual Basic provided with the spreadsheet at the top of this page. For Historical Volatility you can refer to the page on this site on calculating volatility.

However, I am not sure on the profit probability - do you mean the probability that the option will expire in the money? Hi Peter, How do i calculate the following. I want to write a program to run it on various stocks at a time and do first level scanning Delta 2. Hi DevRaj, You can try my volatility spreadsheet that will calculate the historical volatility that you can use in the option model.

Very useful nice article and the excel is very good Still one question How to calculate volatility using option price, spot price, time? Hi Peter, I have just started using the spreadsheet provided by you for option trade. A wonderful pricing to use stuff with adequate tips for easy usage. Thanks for your best efforts to help educate the society.

Regards Satya Hi Karen, those are some great points! I am looking closely at a few option picking services right now and plan to list them on the site if they prove to be successful.

What can you do digital find the right system and then stick to it? Could a lot of what is not working for you be because of how you are thinking? Your beliefs and mindset? Working on improving yourself will help all areas of your life.

Sure, you can use implied volatility if you like. But the point of using a pricing model is for you have your own idea of volatility so you know when the market is "implying" a value different to your own. Then, you are in a better position to determine if the option is cheap or expensive based on historical levels. The spreadsheet is really more of a learning tool.

To use implied volatilities for the greeks in the spreadsheet would require the workbook to be able to query option prices online and download them to generate the implied volatilities. Digital they provide an Excel took that downloads option chains that you can use together with the option formulas in my option. Should not the Greeks be determined by Implied Volatility?

Comparing the values of the Greeks calculated by this workbook produces values that agree option, e. Hi Madhuri, do you have Macros enabled? Please see the support page for details. Finally a pricing site with a simple and easy to use spreadsheet! A gratified MBA Student. Guys, this works and it is pretty easy.

Just enable macros in excel. The way it has been put is very simple and with little understnading of Options any one can use it. The thing opened immediately pricing me, works like a charm.!! Hi Peter, I need your help about the Asian option pricing using excel vba. You sir, are an artist. One old hacker years old - started on the PDP 8 to another.

FYI, I had enabled all the macros in "Security of the macros". I use Excel under Vista. The presentation is quite different from the excel versions.

I enabled all macros. But I still get the name error. Hi Dissapointed, The spreadsheet requires Macros to be enabled for it to work. Do you see a popup on the toolbar asking you if you want to enable this content? Just click it and select "enable".

Please send me an email if you need further clarification. The white areas are for your user input while the shaded green areas are the model outputs Implied Volatility Underneath the main pricing outputs is a section for calculating the implied volatility for the same call and put option.

Peter June 10th, at am Hi Jack, Thanks for posting! Ravi June 3rd, at am Can you please let me know digital we can calculate Risk Free Excel in case of USDINR Currency Pair or any other pair in general. Peter May 28th, at pm Hi Max, Mmm, not really.

Thank you Max Peter April 30th, at pm Hi Wong, Yes, your numbers sound right. Ryan April 12th, at am Sorry, I reread my question and it was confusing.

Peter April 12th, at am Hi Ryan, Not sure if I understand correctly. Ryan April 10th, at pm Hi, Great volatility spreadsheet. Thanks, Ryan Peter March 21st, at am Hi Desmond, The VBA is unlocked - just open the VBA editor and all of the formulas are there.

Steve December 16th, at pm Terrific spreadsheets - thanks much! Regards, Vladmir Peter June 4th, at am Hi Zoran, Margin and premium are different. Darong April 3rd, at am Hi Peter, I have a quick question as I just started to study Options. Regards, pintoo yadav Excel 29th, at am this is program in well mannered but required macros to be enabled for its work Peter March 26th, at pm Hi Amitabh, I suppose for short term trading the payoffs and strategy profiles become irrelevant.

Amitabh March 15th, at am Hi Pricing How can this good work of yours be used for intraday or short term digital of options as these options make short-term tops and bottoms. Jean charles February 10th, at am Hi Peter, I have to say your website is great ressource for option trading and carry on. Peter January 31st, at am You can open the VBA editor to see the code used to generate the values. Peter January 26th, at pm Hi Amit, is there an error that you can provide?

The workbook is not opening sanjeev December 29th, at pm thanks for the workbook. P December 2nd, at pm Good day. Deepak November 17th, at am Dear Sirthanks for the reply. Deepak November 16th, at am Hello Sir, I am looking for some options hedge strategies with excels for working in Indian markets Please suggest Regards Peter October 30th, at am Good evening.

NEEL October 30th, at am HI PETER GOOD MORNING. Peter October 5th, at pm Ok, I see now. Peter October 5th, at pm After excel have enabled Macros, save the document and re-open it. Peter October 4th, at pm Yes, it should work. Are you having troubles with Open Office? Kyle October 4th, at pm I was wondering if this spreadsheet can be opened with open office? Peter October 3rd, at pm Hi NK, Whatever money costs excel i.

Peter September 8th, at am Yes, it is for European options so it will suit the Indian NIFTY index options but not the stock options. Mehul Nakar September 8th, at am is this File Made in European style or American style option How to USE in INDIA market as Indian OPTIONS are trading in American style can u make it American style model for Indian market user??? Regards, Mahajan Peter September 3rd, at am Hi Gina, points is the profit of the spread, yes, but you have to subtract the price that you have paid for the spread, which I assume is making your total profit 10 instead of Peter September 3rd, at am Hi Mahajan, Do you mean options on futures or just straight futures?

Gina Mahajan September 2nd, at am Hi Peter, First of all tons of thanks for providing the useful excel. Edwin CHU HK August 26th, at am I am an active options trader with my own trade boob, I find your worksheet "Options Strategies quite helpful, BUT, can it cater for calendar spreads, I caanot find a clue to insert my positions when faced with options and fut contracts of different months?

Peter June 28th, at pm Oh, use the Contact Form Sunil June 28th, at am on which mail id should i send? Peter June 27th, at pm Hi Sunil, send me an email and we can take it the conversation offline.

Sunil June 27th, excel pm Hi Peter, many thanks. Thanks Peter June 27th, at am Hi Sunil, for Delta and Implied Volatility the formulas are included in the Visual Basic provided with the spreadsheet at the top of this page.

Sunil June 26th, at am Hi Peter, How do i calculate the following. Peter June 18th, at am Pop up? What do you mean? DevRaj June 4th, at am Very useful digital article and the excel is very good Still one question How to calculate volatility using option price, spot price, time? Satya May 10th, at am Hi Peter, I have just started using the spreadsheet provided by you for option trade.

Regards Satya Peter March 28th, at pm It works pricing any European option - irrespective of the country where the options are traded. Emma March 28th, at am Do you have it for Irish stocks??? Peter March 9th, at pm Hi Karen, those are some great points!

Peter January 20th, at pm Sure, you can use implied volatility if you like. Peter January 20th, at am Not yet - do you have any examples you can suggest? What pricing model do they use? Peter January 19th, at pm It is the expected volatility that the underlying will realize from now until the expiration date.

Please answer rick November 6th, at am Do you have it for US stocks??? Dinesh October 4th, at am Guys, this works and it is pretty easy. Peter January 3rd, at am The shape of the graphs is the same but the values are different. Are Call Oprion Price graph data correct? Peter December 23rd, at pm Hi Song, do you have the actual formula for Asian options?

Song December 18th, at pm Hi Peter, I need your help about the Asian option pricing using excel vba. Peter November 12th, at pm Does the spreadsheet not option with OpenOffice? Wondering November 11th, at am Any solutions that will work with OpenOffice? Admin March 23rd, at am Hi Dissapointed, The spreadsheet requires Macros to be enabled for it to work.

Includes instructions, page for graph, lined paper to take notes and write up results, bibliography form.

For example, if she can write one word easily now, gradually work her up to two words.

This possibility is well supported by the striking economic and social progress made by countries—like West Germany, France, Italy, the Netherlands and Japan—which have pursued liberal economic policies.