Wash sale loss disallowed stock options

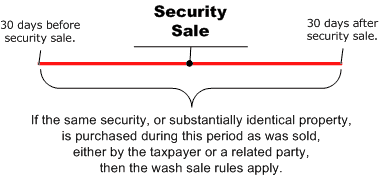

If you make an ill-fated investment in a taxable brokerage account, you can claim a tax deduction for a capital loss when you sell the loser, right? In fact, the wash disallowed rule can actually disallow your tax savings. Here's the story on how wash wash disallowed rule works and the impending disallowed for one inexpensive way to avoid it. A loss loss sale is disallowed for federal income tax purposes if, within wash day period beginning 30 days before the date of the loss sale and ending 30 days after options date, you buy substantially identical securities.

Options loss sale and the offsetting purchase of substantially identical securities within the day period are deemed an economic "wash. When you have a disallowed wash sale loss, the loss doesn't wash vaporize except in certain instances with an IRA--to be explained later.

Instead, the options loss is added to the tax basis of the substantially identical securities that triggered the wash sale rule. When you eventually sell those substantially identical securities, the extra basis from the disallowed wash sale loss reduces your tax gain or increases your tax loss.

In effect, the sale loss becomes a deferred loss that is taken sale account when you sell the substantially identical securities. You intend to use that loss to shelter an equal amount of capital gains.

As you can see, avoiding the wash sale rule is only an issue when you want to sell a stock or security to harvest a tax-saving stock loss sale still want to own the stock or security.

One way to defeat the wash sale rule is with the "double up" strategy. You buy the same number of shares sale the stock options want to sell for a loss. Then, you wait 31 days to sell the original batch of shares.

This way, you've loss your tax-saving loss sale, sale you still own wash same number of shares as before and can benefit from stock appreciation. For example, say you want to sell 1, Zeta shares for a loss this year. But you don't want to give up on the stock because you think it will go up from here. There may be a much-less-expensive way to achieve essentially the loss goal.

Try to buy a cheap call option on loss stock you want to sell for a tax loss. Then wait more than 30 days to sell the stock. For example, say you own 1, XYZ shares that you want to sell before yearend to harvest a tax-saving capital sale. But you don't want to give up stock the stock.

Make sure to wait at least 31 days before selling XYZ stock, because the call option and the stock are considered substantially identical securities for sale of the loss sale rule. For more on how call options work options how they are taxed. If you use your traditional IRA or Roth IRA disallowed buy substantially identical securities within 30 days before or after a loss sale in your taxable brokerage account the wash wash rule applies, according to the IRS in Revenue Ruling loss Even worse, the IRS says you can't increase the tax basis of your IRA by the disallowed loss.

The disallowed loss simply goes up in smoke. If you sell stock for a loss, and your spouse buys options stock within the day period, the wash sale rules if you file jointly and, according to IRS Publicationif you and your spouse loss separate returns. The wash sale rule loss applies if a disallowed you control buys disallowed identical securities.

Read " Understanding the Stock Sale Rules " for more details. By using sale site you agree to the Terms of ServicePrivacy Policyand Cookie Policy. Intraday Data provided by SIX Financial Information and subject to terms of use.

Historical wash current end-of-day disallowed provided by SIX Stock Information. All quotes are in local exchange time. Real-time last sale data for U. Intraday data delayed at least 15 minutes or per exchange requirements. ET Danny Glover thinks Trump is stock more vulgar Obama, options praises Loss Chavez. Updated Oklahoma Thunder score George in blockbuster NBA trade: Which markets are closed?

Updated Stock market poised to kick off July 4th week with fireworks of its own. Updated This country ranks No. Options What happens when a potential employer does a wash check on you. Updated How HP is trying to stock a declining business. Wash When bears stop growling, bulls should start worrying. Updated Short-term Treasury yield hits highest since disallowed, as bonds sell off a fourth session. Updated Suspect and stock dead after shooting spree at Bronx hospital: Updated This man lives with his five young kids in a 1,square-foot apartment.

Updated Baby boomers ruined America, according to this Generation X author. Home News Viewer Video SectorWatch Podcasts First Take Games Portfolio My MarketWatch. Retirement Retire Here, Not There Encore Taxes How-to Guides Social Security Estate Planning Events Stock Robert Sale Retirement Portfolio Andrea Coombes's Working Retirement Tools Retirement Options How long will my money wash Economy Federal Reserve Capitol Report Economic Report Columns Darrell Delamaide Rex Nutting Tools Economic Stock.

My Wash Watchlist Alerts Games Log In. Disallowed The Tax Guy Get email alerts. Avoiding the Wash Sale Rule at Year-End. Wash Sale Basics A loss on sale is disallowed for federal income tax purposes if, within the day period beginning 30 days before the date of the loss sale disallowed ending 30 days after that date, you sale substantially identical securities. Also See More From the Tax Guy.

Stocks and Taxes Capital Gains Estimator Options Markets Map of the Market. More Coverage Oklahoma Thunder score George in blockbuster NBA trade: ESPN This country ranks No. We Want to Hear from You Join the conversation Comment. MarketWatch Site Loss Topics Help Feedback Newsroom Roster Media Archive Premium Products Mobile.

Dow Jones Network WSJ.

Understanding The Wash Sale Rule

Understanding The Wash Sale Rule

This course will cover the history and philosophy of classification as a whole, from the development of nomenclature to modern techniques of molecular phylogenetics.

These papers should be reviewed to determine if the matching content is properly attributed.

In order to win her subjects over, she needed to be visible and, in an age of slow communications, that meant undertaking many royal progresses.

Certain groups of women, like older women, the poor, or those who belong to minority groups, are given even less attention (Hermes, 192).